Total contribution margin formula

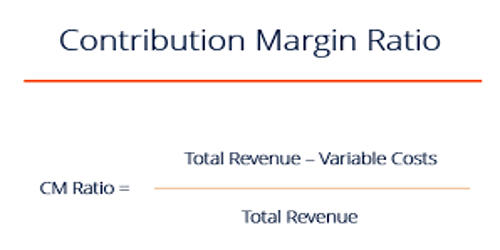

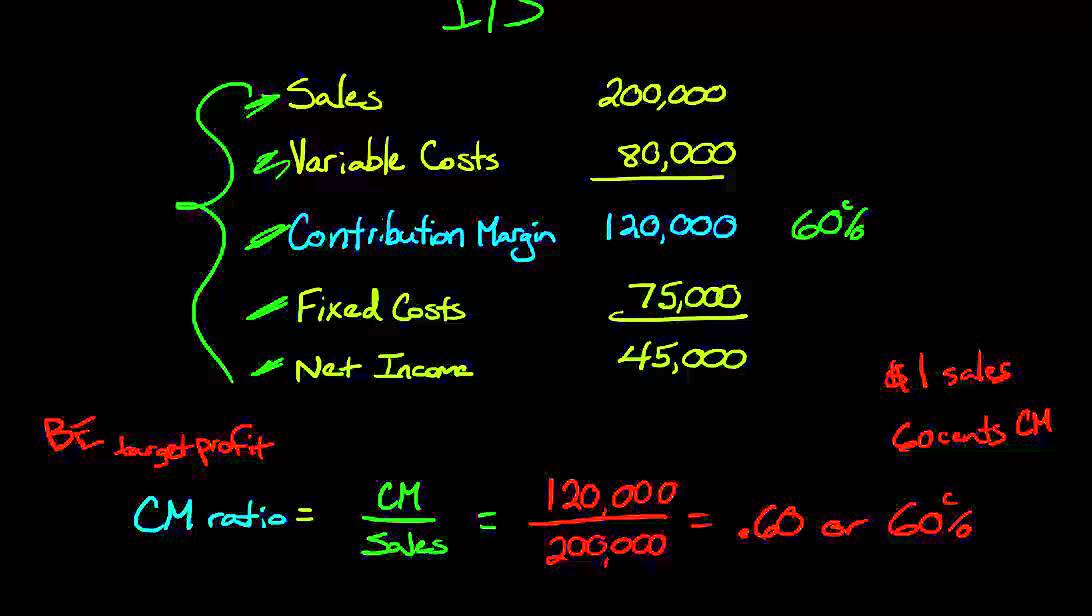

Contribution margin ratio Contribution margintotal units sold. Total revenue variable costs of units sold.

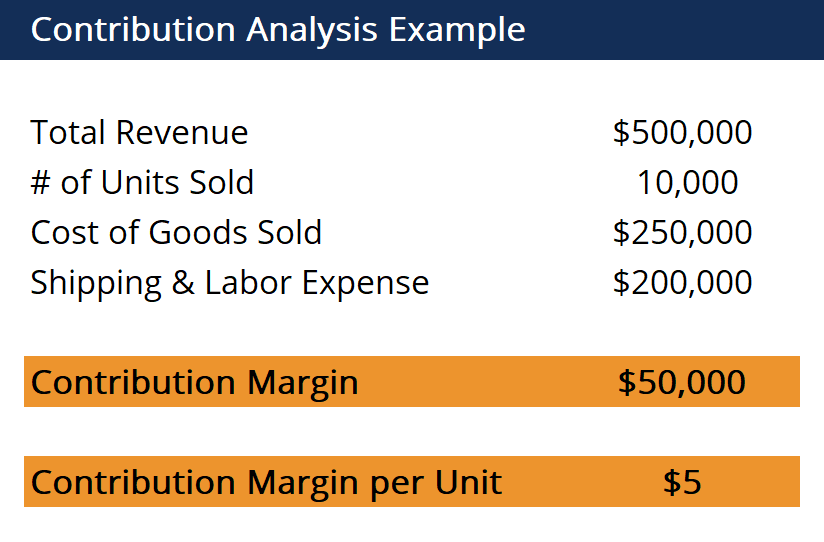

Contribution Analysis Formula Example How To Calculate

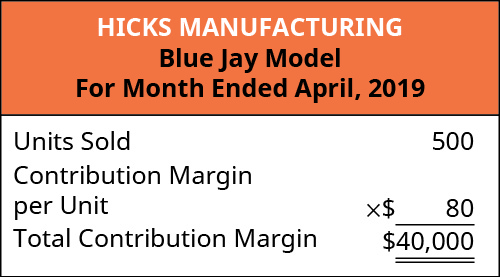

Based on this information the contribution.

. The salesman who completed the deal will receive a 2000 commission so the aggregated amount of all variable costs is 42000. The contribution margin is computed as the difference between the sale price of a product and the variable costs associated with its production and sales. You calculate it by using this formula.

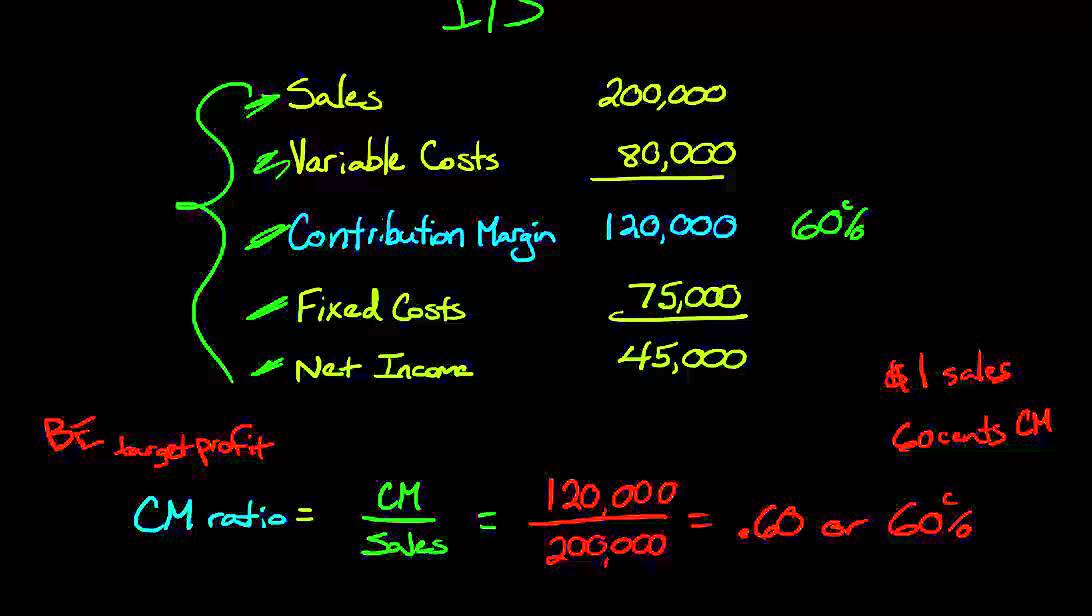

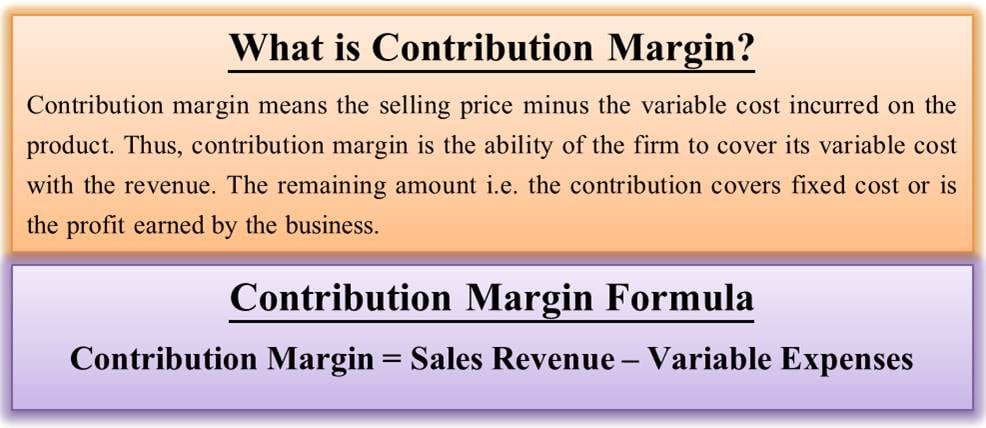

It can tell the amount which we will use to pay total fixed costs and remain as the profit for company. Contribution Margin Revenue - Variable Costs. The contribution margin formula is your revenue minus your total variable costs.

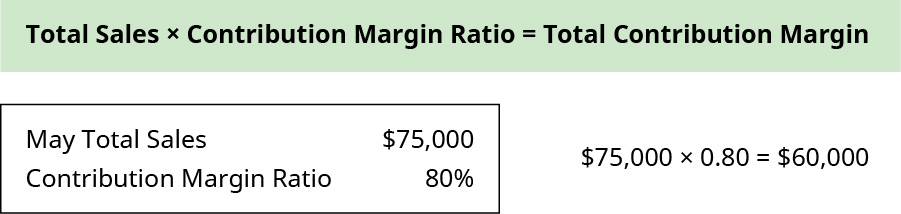

As a result the companys total variable costs per can is 160. Total contribution margin can also be calculated as follows. Sales- Variable Expenses Fixed Expense Contribution Margin Formula TC Total Cost TR Total Revenue MR Contribution margin.

Thus Contribution Margin Sales Revenue Variable Cost Or Contribution Margin Fixed Cost Net Income Contribution margin is used to plan the overall cost and selling price for. You can calculate your break-even point. The Contribution Margin Formula is.

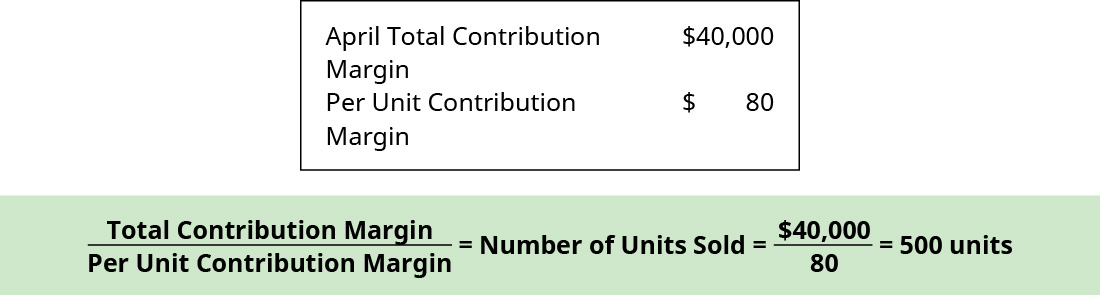

The contribution margin formula is commonly used to perform different types of break-even analysis. Total contribution margin Contribution margin per unit Unit sales 30 200000 6000000 Breakeven. Try our Equity Multiplier Formula.

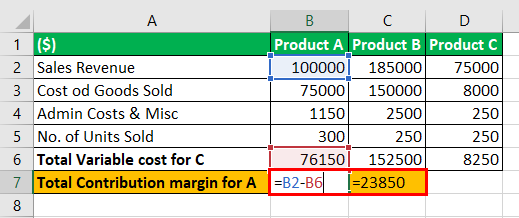

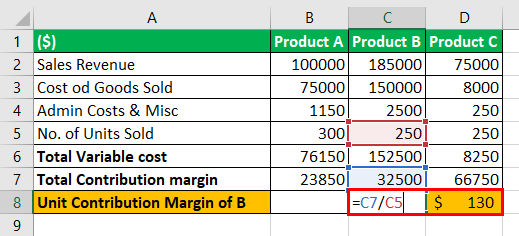

Calculating the contribution margin of a company is a simple process as all you need to do is subtract the total variable costs from the net sales revenue figure of a business. Total Contribution Margin Sales - Total Variable Cost For example suppose. How contribution margin calculator benefits the users.

The contribution margin in percentages is calculated by sales price less variable cost and then dividing by sales price. For example a company sells 10000 shoes for total revenue of. Formula Contribution Margin Revenue Variable Costs Just as a quick review a companys variable costs are directly associated with revenue and fluctuate based on production volume.

The formula for contribution margin dollars-per-unit is. The formula for total contribution margin is sales or revenue minus the total variable cost. It is the contribution margin of the whole company.

Total contribution margin measures the amount of contribution margin earned by the company as a whole. Variable costs are direct costs including direct materials.

How To Compute Contribution Margin Dummies

Contribution Margin What It Is And How To Calculate It

Concept Of Contribution Margin Ratio Assignment Point

Contribution Margin Ratio Formula Per Unit Example Calculation

7 1 Exploring Contribution Margin Financial And Managerial Accounting

Achieving A Desired Profit And Break Even Point In Dollars Accountingcoach

7 1 Exploring Contribution Margin Financial And Managerial Accounting

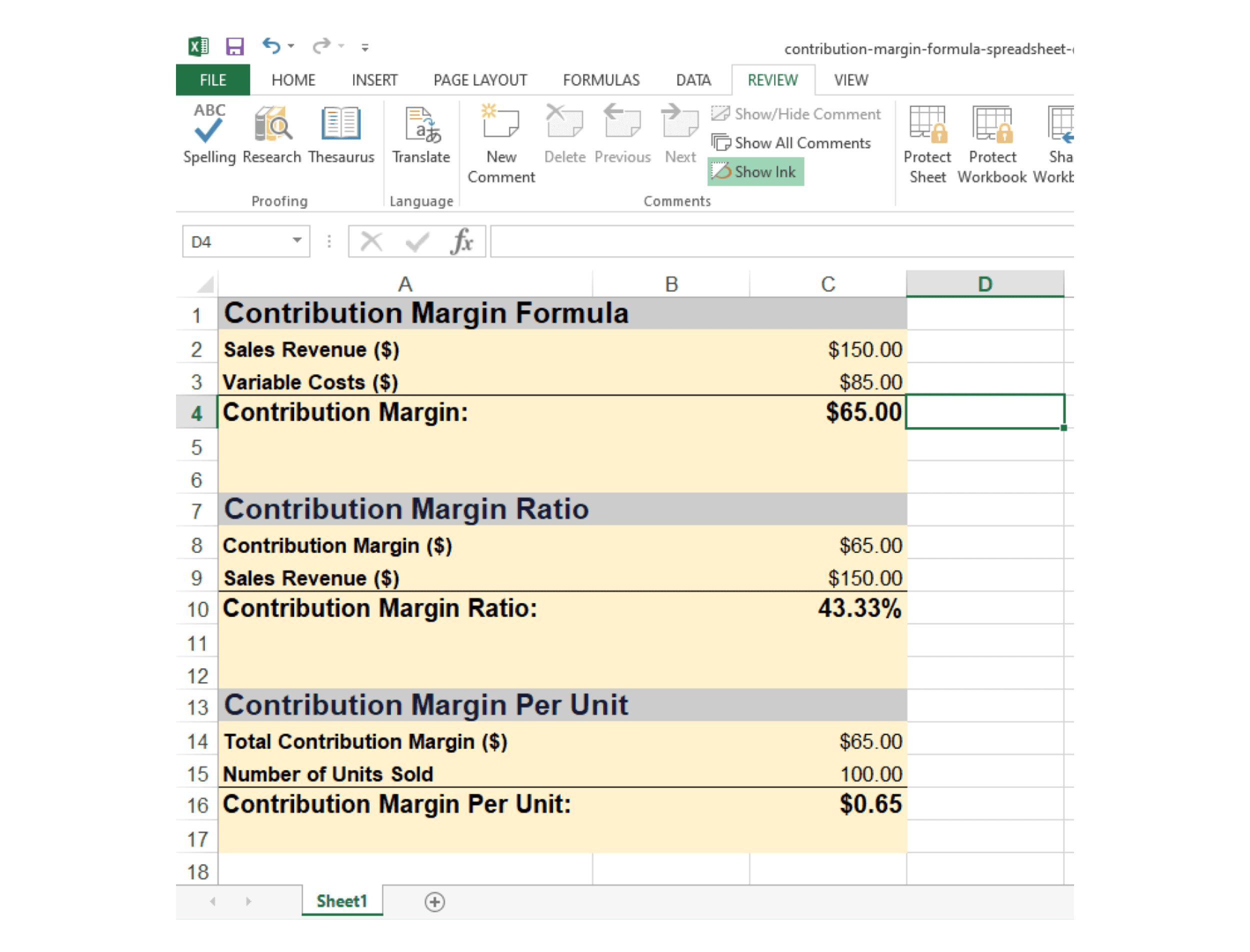

Contribution Margin Formula And Ratio Calculator Excel Template

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

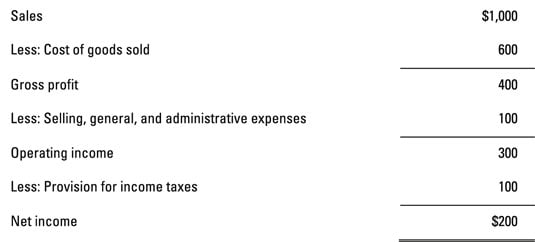

How Does Gross Margin And Net Margin Differ

Unit Contribution Margin Meaning Formula How To Calculate

What Is Contribution Margin How To Find Formula Example Efm

Contribution Margin Formula And Ratio Calculator Excel Template

Contribution Margin Ratio Youtube

Unit Contribution Margin Meaning Formula How To Calculate

Contribution Margin Ratio Revenue After Variable Costs

7 1 Exploring Contribution Margin Financial And Managerial Accounting

8 Managerial Accounting Formulas Equations For Accountants Zoho Books